Imminent job relocation

This article addresses the role of an investor and how it benefits those who need to sell their house fast. Instead of merely listing bullet points, the format is divided into two real world dialogues. That way, the reader can easily gauge the financial and logistical challenges of selling a home and why investors have recently become a prominent part of the real estate landscape.

Brandon: (Sitting on the couch, holding a cup of coffee) Thanks for coming over, Eric. I’m sure you can appreciate that this is a big decision for us. I need to sell my house fast before moving to Texas for my new job. This transition away from this area is exciting and a big step, but there’s a lot to figure out here.

Eric: Absolutely, Brandon. I’m here to make the bulk of this process a lot easier for you. I know that selling a house can be overwhelming, but I’m in business to make quick and seamless transactions.

Latisha: (Leaning forward in her chair) We’ve been doing some research, Eric, and honestly, we’re a little hesitant about working with an investor. We’ve heard the stories about people being disrespected by lowball offers on their home’s sale price.

Eric: (Nods understandingly) That’s a fair concern, Latisha. A lot of misconceptions about real estate investors are out there, so it’s good that we’re having this conversation. One reason quotes from a real estate investor are typically lower than what you may get by selling on the open market is that the costs of renovating the house are factored in. For you to get the full market value on your home you yourselves would have to front those costs. Anyway, my goal is to provide value while solving problems for homeowners so they can move on. Why don’t we start first with what’s the most important issue that you’re dealing with?

Brandon: (Looks at Latisha, then back at Eric) Timing is huge for us. I start my new job in three weeks, and we’re not able to maintain this house and relocate at the same time. We need it sold quickly so we’re not distracted after the move.

Latisha: And it’s unreasonable for us to sink money into repairs for staging. We know the roof needs work and the kitchen’s decor is outdated. The house would probably get stagnant on the market because a typical buyer doesn’t want to fix things after the purchase.

Eric: (Leans in slightly) I understand. And when the house sits on the market for more than a month a negative stigma gets attached to it. The reality is that traditional sales can take months if there are repairs to address. I buy homes as-is, no need for repairs, staging or cleaning. You just hand me the keys and I take care of the rest.

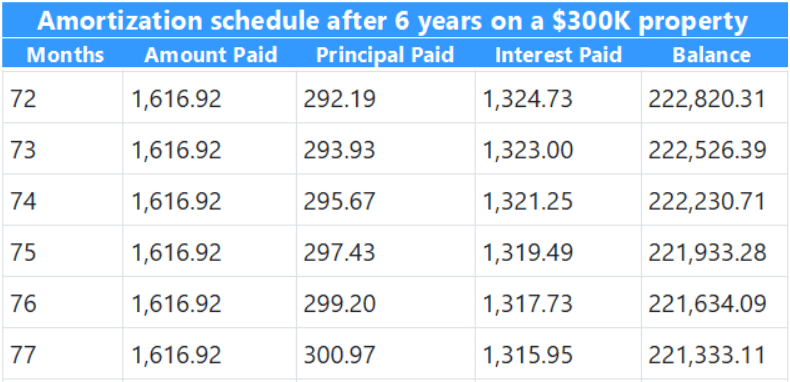

Brandon: That sounds convenient but at what cost? We’ve been in this house for seven years. I need to sell my house fast but we’ve built a lot of equity and we’d like to get a fair price.

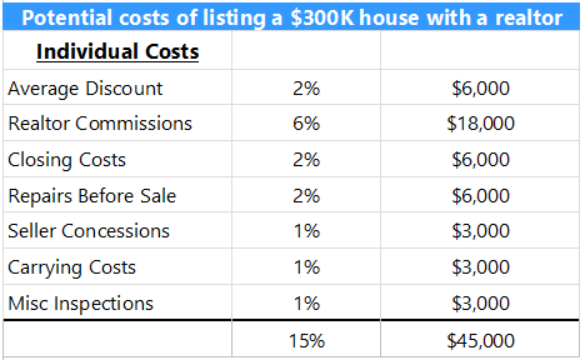

Eric: (Nods) Totally understandable. Let’s break everything down. If you sold the traditional way, you’d need to hire an agent, pay their commission (usually around 5-6% of the sale price) and potentially cover closing costs for the buyer. There’s also the cost of repairs and updates to make the home market-ready. All of that adds up, and even with the repairs done, it doesn’t guarantee a fast sale.

Latisha: (Crosses her arms) So how does your process compare?

Eric: Great question. When I buy a house of course there’s no agent commission because there’s no agent… and I cover all the closing costs. The amount that’s left over is what you walk away with, in cash. Sure, I might offer below the market value because I’m taking on certain risks and repair expenses. But when you consider the money saved on fees and lost time, many homeowners come out ahead.

Brandon: (Leaning back, thinking) I see your point about the costs. But how do we know we’re not being taken advantage of? No offense but it’s hard to trust someone from an industry that’s known for being… less than reputable.

Eric: (Smiling) I get it. Trust is earned. Let me share about how I operate. First, I always provide a transparent cost breakdown of my quotes. I look at comparable sales in the area, factor in repair renovation costs, and add in a fair profit margin for my business.

Brandon: But what if we could get more by listing it traditionally? You know I have to sell my house fast but aren’t we leaving money on the table that isn’t being discussed here?

Eric: That’s a valid concern, Brandon. Traditional sales might net a higher offer on paper, but it’s not just about the sale price. Think about the carrying costs, residual mortgage payments, utilities and property taxes that you’d be paying while waiting for the house to sell. Then there’s the time and stress of dealing with showings and negotiations. For you to take this on means that Latisha stays behind. With me, you get certainty and speed. You know exactly how much you’ll walk away with and you can focus solely on your move to Texas.

Brandon: (Nods slowly) I can see how the convenience and speed might outweigh a higher sale price. Plus, I just don’t have the time and know-how to get this house up to snuff.

Eric: Exactly. But every homeowner’s situation is different. For some, waiting months for a traditional sale works fine. But for others like you two, who are facing a time crunch and logistical challenges that might set you back on preparation for your new job.

Get a quick close

Avoid extra mortgage payments

* Based on a 30 year fixed rate loan @ 7.125%

Latisha: (Glancing at Brandon) Especially in our situation, selling our house fast with an investor does sound appealing. What would the next steps look like?

Eric: (Pulling a folder from his bag) First, I’d need to take a quick walkthrough of the house to determine its condition. Then, I’ll do some calculations and present you with a cash offer. If you’re happy with it, we can close in as little as two weeks or on a timeline that works best for you.

Brandon: And if we don’t like the offer?

Eric: (Smiling) No hard feelings. I provide solutions not pressure. If my offer doesn’t work for you, you’ll have more information to make an even better decision.

Latisha: That’s reassuring. Like I said before, we’ve heard stories about investors taking advantage of desperate sellers.

Eric: Sadly, that does happen but rest assured that I’m upfront and transparent. It’s impossible to build a strong business without referrals and long-term relationships. Happy clients are the cornerstone of any successful business.

Brandon: (Looks at Latisha) What do you think Tish? Should we at least hear him out?

Latisha: I think it’s worth exploring. And if the numbers make sense for us, it could save us a lot of stress and headache.

Eric: (Smiling warmly) Great! Why don’t we start with a quick walkthrough? You can provide any needful commentary if I see some issues. Sound good?

Brandon and Latisha: Sounds good.

Conclusion

With both scenarios presented in this article, the sellers at first had a hard time rationalizing getting paid a lower price for their homes. But when they realized that the investor must cover the repairs out of his own pocket, the transaction made sense. Furthermore, a list of extra costs related to selling a home the traditional way only supports the necessity for investors in the real estate ecosystem.

One point that is often missed in cases like Brandon’s, is that the DIY approach to house renovations can dilute a person to such an extent that he is ineffective in his professional life. In his case, even if he had the time and finances to renovate, he could have ended his career if his office workload was demanding.